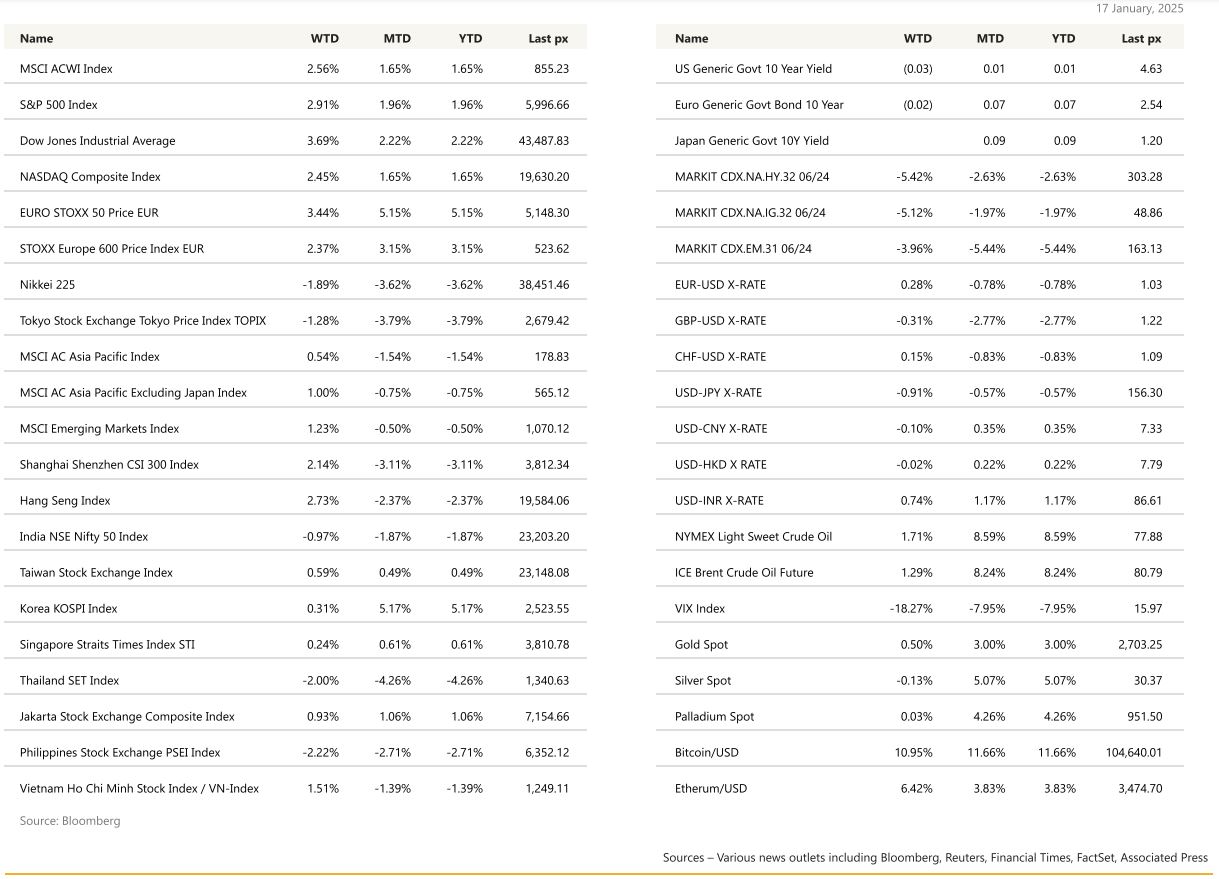

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

US markets closed the week with a banger as the S&P 500 clocked in a gain of 2.93%. The Russell 2000 Index, comprising the smallest 2000 companies in the Russell 3000 Index closed up 3.97% suggesting further broadening of gains in equities. Inflation data headed in the right direction and earnings from banks overwhelmed. Wednesday’s cooler-than-expected consumer price print and Fed Governor Christopher Waller’s comments on Thursday about a possible rate reduction in the first half of the year helped buoy sentiment. Core consumer price index — which excludes food and energy costs — increased 0.2% after rising 0.3% four straight months, core YoY fell to 3.2% from 3.3% whilst the headline CPI YoY came in as expected at 2.9%. PPI the day before rose 0.2% from a month earlier, below forecast of a 0.4% gain.

December retail sales missed estimates month-over-month while weekly jobless claims rose more than expected — two signs of economic cooling that may ease concern about the Federal Reserve’s interest-rate path. The softer inflation numbers are likely insufficient to place a January cut on the table but it does strengthen the case that the Fed’s cutting cycle has not yet run its course. The UST10Y yield retreated to 4.627% and the 2’s closed at 4.282% after hitting a high of 4.81% and 4.42% respectively. The VIX also retreated to close at 15.97. In other releases, the Fed’s Beige Book report noted that economic activity increased ‘slightly to moderately in late Nov/December’ whilst the Empire State Manufacturing Index fell to -12.6 (exp. 3.0). Meanwhile, a report late on Friday said that Trump and Chinese President Xi Jinping spoke by telephone, may have soothed some anxiety about trade tensions.

All eyes will be on President Donald Trump as he re-takes his oath as the next US president today, and stock investors will have one big reason to breathe a sigh of relief. History shows the performance of the equities benchmark over a three-month period usually improves after inauguration day!

For this shortened week, we will have a much lighter data set with only S&P Global US manufacturing, services and composites and U. of Mich. inflation/consumer expectations of significance. Markets will be closed today in observance of Martin Luther King day.

Europe

European markets ended in positive territory on Friday, with London’s FTSE 100 closing at a record high. The UK’s miningheavy FTSE 100 gained 3.11%, and the Eurostoxx 600 finished the week up 2.37%, buoyed by mining stocks, which rose 2% following a Bloomberg report that Glencore was in discussions with Rio Tinto about a potential merger—the largest in the mining industry’s history. Rio Tinto, the world’s secondlargest miner, had a market value of approximately $104 billion as London trading began on Friday, while Glencore was valued at around $56 billion. A merger between the two would create the largest-ever mining deal, though it would face numerous challenges. Glencore’s large copper assets are highly sought after in the energy transition, but its substantial coal business could be a sticking point for Rio Tinto.

Novo Nordisk dropped 4.3% on Friday after the US Centers for Medicare and Medicaid Services included the company’s weight loss drugs, Wegovy and Ozempic, in a list of 15 medications subject to price negotiations under government healthcare programs. LVMH reclaimed its position as Europe s largest company after Novo Nordisk s shares fell.

Meanwhile, European car manufacturers, including MercedesBenz and BMW, have urged the European Commission to strike a grand bargain with US President-elect Donald Trump. The carmakers are seeking protection for the European auto industry, which faces challenges from Trump s proposed tariffs of up to 20% on US imports, at a time when the industry is dealing with the expensive shift to electric vehicles and growing competition from China. Over 20% of EU car exports go to the US.

The UK reported disappointing data. First, the ONS revealed a 0.3% decline in sales volumes, falling well below economists expectations of a 0.4% increase. Analysts attribute the downturn to ongoing consumer caution amid living cost concerns, despite easing inflation. Additionally, UK economic growth for November came in weaker than anticipated, while inflation dropped more than expected to 2.5%. These figures prompted traders to increase their bets on the extent of Bank of England interest rate cuts this year, with more than 70 basis points of cuts priced in by late morning on Friday, up from around 65 basis points the previous day.

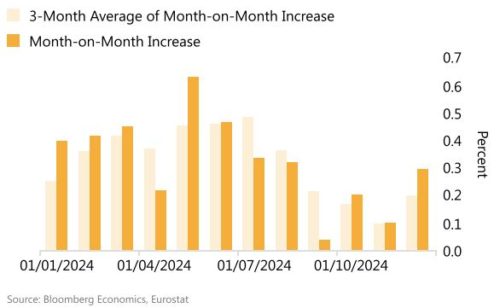

In the Eurozone, annual inflation was confirmed at 2.4% for December 2024, up from 2.2% in November, while core inflation remained steady at 2.7%, indicating persistent underlying price pressures. Services were the main driver of inflation, contributing about 1.8% to the headline figure. Energy costs rose by 0.1% in December, reversing the -2% decline in November, marking the first positive change since July. Services inflation in the euro area increased to 4% year-on-year in December, up from 3.9% in November, remaining stuck around this level since May. However, the three-month-on-three-month seasonally adjusted annualized change in services prices fell to 1.9% from 2%.

Month-on-Month Increases Decline

With economic growth stagnating, investors are betting on further interest rate cuts by the European Central Bank. A 25- basis-point rate cut is fully priced in for the ECB’s 30 January meeting, with additional cuts expected later in the year.

French Minister François Bayrou survived a no-confidence vote last Thursday, called by the hard left, after the centre-left Socialist Party declined to support the motion. In the vote, 131 lawmakers were in favor of the motion, far short of the 288 votes required.

This week, we will see the Eurozone flash consumer confidence and the Eurozone PMI.

Asia

The world’s biggest bond market and global bellwether is leading a reset higher in borrowing costs, with the prospect of a prolonged period of elevated rates carrying consequences for economies and assets everywhere. Just days into 2025, yields on US government debt were surging as the risks to supposedly super-safe assets mount. The CPI numbers mid-week came as a huge relief to the market.

By mid-week, most markets in Asia were down for the year, with one exception, the Kospi in South Korea closing higher so far for the year in 2025. South Korea’s central bank unexpectedly left its policy interest rate unchanged on Thursday, weighing the impact of its back-to-back cuts last year while supporting the won which has weakened to a 15-year low versus the U.S. dollar in recent weeks. MSCI Asia ex Japan closed the week +1.02%.

Investors in Asia remain cautious as they prepare for a potential rate hike by the BOJ in the coming months. Governor Kazuo Ueda said that he’s going to raise the benchmark rate if the economy continues to improve this year in a speech last week, avoiding giving any specific hints on the timing of the next hike. Japan’s wholesale inflation remained at 3.8% in December 2024. The steady inflation rate, which matched market expectations, was also influenced by rising fuel costs due to the removal of government subsidies. Additionally, the yen’s weakness led to higher import prices, contributing to overall cost pressures for companies. The Bank of Japan is considering raising interest rates at their January 23-24 meeting.

China trade data came in stronger than expected. China’s imports and exports grew by 5% year-on-year in 2024 to reach 43.85 trillion yuan ($5.98 trillion), with the total foreign trade volume setting a new record high, according to data released by the General Administration of Customs (GAC) on Monday.

Bank Indonesia to cut BI Rate by 25bps to 5.75%. Large-cap bank stocks and other rate-sensitive stocks, especially property, are expected to continue strengthening on the back of this. BI’s surprise decision means it has shifted its focus to economic growth, in tandem with the government’s 8% GDP growth target. The move came after a prolonged selloff in the country’s government bonds, with the 10-year yield rising by more than 50 basis points since the US election on Nov. 6 — the largest such jump in emerging Asia. Indonesia’s 10-year bond yield rose to 7.32% before the decision, hitting its highest level since Nov. 2022. It moved lower after the cut, closing at around 7.27%. Global funds pulled out $152 million from Indonesia’s bond market on Monday, the largest single-day outflow in two months, according to data from the Ministry of Finance. The outflow followed a strong US employment report on Friday, which fueled bets that the Federal Reserve may slow the pace of its own rate cuts.

Reserve Bank of India (RBI) has announced that it will conduct daily variable rate repo (VRR) auctions on all working days in Mumbai, until further notice. The daily auctions, aimed at easing the current liquidity tightness in the banking system, will begin on Friday, with a notified amount of Rs 50,000 crore. The liquidity deficit in the banking system has exceeded Rs 2 trillion in the past few days.

GeoPolitics

US- China: China’s President Xi Jinping will send a high-level envoy to Donald Trump’s inauguration, in an unprecedented move designed to reduce friction between the countries at the start of the new US administration. By sending a special envoy of significant stature to get meetings with Trump and his cabinet, Xi can demonstrate that he wishes to get off on the right foot with the Trump administration without risking that he could return home empty-handed or publicly embarrassed.

US- Greenland: Greenland Is Ready to Cooperate With Trump, Prime Minister Says. Both Greenland’s PM Egede and Denmark’s Prime Minister Mette Frederiksen have on several occasions stressed that Greenland is not for sale, and that it’s up to the Greenlandic people to decide the future of the island. The renewed focus on Greenland has given the territory more leverage in its relationship with Denmark, putting the world’s largest island in an unexpected position of power.

Israel – Palestine: Israel and Hamas agreed to a ceasefire deal Qatari and US officials said, bringing at least a temporary halt to the war in the Gaza Strip that has raged for more than 15 months. The multiphase agreement, due to take effect on Sunday, a day before Donald Trump returns to office as US president. However, the parties still had to give final approvalÃ

- Phase 1: The first phase will involve a 42-day truce, during which 33 Israeli hostages — including children, all female prisoners, the sick and elderly — will be freed in exchange for Palestinian prisoners held in Israeli jails and a dramatic increase in humanitarian aid deliveries into Gaza.

- Phase 2: The two parties would begin negotiating the second phase no later than day 16 of the truce. During this period the remaining hostages, including male soldiers, are meant to be released in exchange for more Palestinian prisoners. If fully implemented, the second phase would also lead to a permanent ceasefire and the full withdrawal of Israeli troops from Gaza.

- Final Phase: The final phase would involve the return of all remaining bodies of hostages who died, and the reconstruction of Gaza, under the supervision of Egypt, Qatar and the UN.

Credit Treasuries

December PPI in the US came out below expectations. PPI-ex MoM came out flat Vs +0.30% expected which translate into a YoY of +3.50% Vs +3.80% expected.

The US CPI release, as that really was the main swing factor notwithstanding the earlier global boost from lower UK CPI numbers. For markets, the main headline was that core US CPI fell to a monthly +0.2% pace in December (vs. +0.3% expected), so the year-on-year rate ticked down a tenth to +3.2%. Although in a trillion dollar plus sliding doors moment, it was interesting the YoY core inflation was 0.002 percentage points away from staying at 3.3% as it came in at 3.248%.

However, for all the market excitement, it wasn’t actually a great inflation report by several measures. In fact, the headline CPI print was at a 10-month high of +0.39%, and it didn’t see a downside surprise like the core print. Moreover, there are growing signs that this stickiness isn’t just a blip, as the 3m annualized rate of CPI reached an 8-month high of +3.9%, so that’s not where the Fed would normally be comfortable cutting rates. Plus, it’s worth bearing in mind that this report is covering December, and we’re soon about to face the potential impact from tariffs, whilst Bloomberg’s Commodity Spot Index (+1.40%) just hit its highest level since January 2023.

December US Retail Sales control group increased by 0.70% Vs +0.40% expected & December Industrial Production increased by 0.90% Vs +0.30% expected. Previous Month data were revised up 0.20% compared to -0.10% that was announced previously.

The main driver last week was definitely the CPI, which had a huge impact on financial markets and interest rates. The US Treasury curve bull flattened with the 2years yield down by 12bps, 5years yield was down by 17bps, 10years yield gave up 15bps and 30years yield was down by 11bps. US IG 5years credit spreads tightened by around 3.5bps while US HY 5years credit spreads tightened by 21bps. US IG managed to gain 1.60% last week and US HY gained around 1.20%. Leverage loans gained about 5bps. Market forecast that the FED will now cut its main interest rate by 37bps by the end of this year compared to 28bps at the start of last week.

The US markets will be close today (Martin Luther King’s day). Today celebrate the first day in the office for Trump second time in the White House. The main economic data this week in the US will be the January preliminary Manufacturing & Services PMI’s, the January University of Michigan sentiment index, and quite a lot of date about the health of the real estate market.

FX

DXY USD Index fell 0.28% to close the week at 109.35, driven by downside surprises in US CPI, with core rising by 0.225% m/m (C: 0.3%).

In addition, reports of the incoming administration looking into gradual tariff hikes supported USD weakness. In other US Macro data, Headline PPI rose 0.2% m/m in December (C: 0.4%; P: 0.4%), while PPI ex Food, Energy, Trade rose 0.1% m/m (C: 0.3%; P: 0.1%). Retail sales missed expectations on headline (A: 0.4%; C: 0.6%) but beat on the more relevant core-control (A: 0.7%; C: 0.4%). NFIB Small Business Optimism rose to 105.1 in December (P: 101.7) after a large rise in November, returning to prepandemic levels. Apart from the data, we also have Fed Governor Waller voicing optimism about inflation, where cooperative data could be sufficient to justify 3-4 25bp cuts this year. Based on OIS, market is currently pricing for 36 bps of cuts in 2025, up from 28 bps of cuts a week ago.

European Currencies was mixed against USD; EURUSD rose 0.28% to 1.0244, GBPUSD fell 0.31% to 1.2169, USDCHF fell 0.15% to 0.915. GBP underperformed amidst negative surprises in UK Macro data. UK CPI surprised on the downside, with services inflation slowing to 4.4% y/y (C: 4.8%; P: 5.0%), 37bp lower than the BoE forecast. Headline CPI slowed to 2.5% y/y (C: 2.6%; P: 2.6%) while Core CPI slowed to 3.2% y/y (C: 3.4%; P: 3.5%) in December. UK Retail Sales unexpectedly contracts in December, dragged down by food store volumes and online retailing.

Antipodean Currencies rose against USD, driven by USD weakness; AUDUSD rose 0.75% to 0.6193, NZDUSD rose 0.50% to 0.5585. In Australia, Employment rose 56k in December (C: 15k; P: 36k). The Participation Rate rose to 67.1% (C: 67.0%; P: 67.0%), with the Unemployment Rate ticking back up to 4.0% (C: 4.0%; P: 3.9%).

USDJPY fell 0.91% to 156.30. In addition to USD weakness, we have media report that BoJ see a good chance of Jan rate hike. BoJ Governor Ueda says the branch managers’ meeting offered encouraging views on wage increases and that the BoJ will discuss a rate hike at the upcoming meeting. On Japan Macro, Headline PPI rose 0.3% m/m (C: 0.4%; P: 0.3%), largely due to higher prices in electric power, gas, and agriculture products, particularly rice. Resistance level at 158/160. Support level at 155/152/147.

USDCNH fell 0.30% to 7.3415, driven mostly by USD weakness. On China Macro data, upside surprise in China 4Q24 GDP (A: 5.4%, C: 5.0%) driven by industrial production (A: 6.2%, C: 5.4%) and retail sales (A: 3.7%, C: 3.6%). In addition, PBoC vows to strengthen management of the FX market and adjusts its rules for cross-border flows to support the currency. However, these announcements did not have any material upside impact on CNH.

Oil & Commodities

Oil Futures rose last week, with WTI and Brent futures rising 1.71% and 1.29% to 77.88 and 80.79 respectively, amid concerns of less supply due to heightened US sanctions. IEA said the 160 tankers sanctioned by the US last week had shipped more than 1.6 million barrels a day of Russian oil in 2024, about 22% of the country’s seaborne exports. It also noted that previous rounds of curbs had been “highly effective, reducing the activity of designated tankers by 90%.” In the US, inventories fell for an eighth week to hit the lowest since April 2022, according to official data on Wednesday. The rise in oil prices came even amid news that after 15 months of war Israel and Hamas had agreed a ceasefire deal, which came into effect on Sunday.

Gold rose 0.50% to 2703.25 driven by lower USD as US yields fell. In addition, gold price was supported as many traders are cautious that the US president could herald an era of sweeping tariffs, trade wars, and widespread market upheaval on inauguration day today.

Economic News This Week

- Monday – JP Core Machine Orders/ Indust. Pdtn, UK Rightmove Hse Prices, CH LPR

- Tuesday – UK Employ., EU Zew Exp., CA CPI

- Wednesday – NZ CPI, US Mortg. App./ Leading Index

- Thursday – Norway Rate Decision, CA Retail Sales, US Initial Jobless Claims, EU Cons. Confid.

- Friday – JP Natl CPI/ BoJ Rate Decision, AU/JP/EU/UK/US Mfg/Svc/Comps PMI Jan Prelim, US UMich/ Existing Home Sales

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.